Jordan Schoenfeld

C.V. | SSRN | Google Scholar | LinkedIn

I am currently an Associate Professor at The Ohio State University Fisher College of Business.

Research interests: financial contracts; the role of information in the financial markets; corporate use of big data; climate finance; cyber risks.

Recent press coverage: The FinReg Blog featured my coauthored paper on smart contract audits. The Harvard Law School Forum featured my paper on corporate cyber risk and SOC audits. The Harvard Law School Forum and Bloomberg featured my paper on shareholder contracts. Columbia Law School's blog featured my coauthored paper on voluntary disclosures by activist shareholders. Selected working papers are available on SSRN.

Peer-reviewed research publications:

10. Decentralized Finance (DeFi) Assurance: Early Evidence

(with T. Bourveau and J. Brendel) Review of Accounting Studies, forthcoming

9. Voluntary Disclosures by Activist Investors: The Role of Activist Expectations

(with R. McDonough and V. Nagar) Review of Accounting Studies, forthcoming

8. Measuring weather exposure with annual reports

(with V. Nagar) Review of Accounting Studies, 2024 (lead article) (link) (download data)

7. Cyber risk and voluntary Service Organization Control (SOC) Audits

(sole-authored) Review of Accounting Studies, 2024 (link)

6. Shareholder Monitoring and Discretionary Disclosure

(with V. Nagar) Journal of Accounting and Economics, 2021 (link)

5. Contracts between Firms and Shareholders

(sole-authored) Journal of Accounting Research, 2020 (link)

4. The effect of economic policy uncertainty on investor information asymmetry and management disclosures

(with V. Nagar and L. Wellman) Journal of Accounting and Economics, 2019 (link)

3. Manager-analyst conversations in earnings conference calls

(with J. V. Chen and V. Nagar) Review of Accounting Studies, 2018 (link)

2. Shareholder activism and voluntary disclosure

(with T. Bourveau) Review of Accounting Studies, 2017 (link)

1. The effect of voluntary disclosure on stock liquidity: New evidence from index funds

(sole-authored) Journal of Accounting and Economics, 2017 (link)

Teaching: I have created and taught several MBA, exec ed, MAcc, and undergrad accounting courses, including "Accounting and Big Data," "Accounting for Startup Founders," and "Financial Reporting for Chief Financial Officers." Why have I created new accounting courses? From undergrad to MBA to exec ed, accounting enrollments are down, which is likely because accounting is often taught in a linear manner that lacks relevance to aspiring leaders and managers. We often focus on debits and credits to make our courses "hard," while failing to engage in deep discussions of how financial reporting can help managers navigate the perils and challenges of the financial markets. We too infrequently discuss how accounting outputs interact with the implicit and explicit nexus of contracts and relationships among all stakeholders in an organization. My pedagogical goal in all my courses is to teach accounting and financial reporting in a manner that sets a foundation for students to solve problems in new and continuously changing business environments.

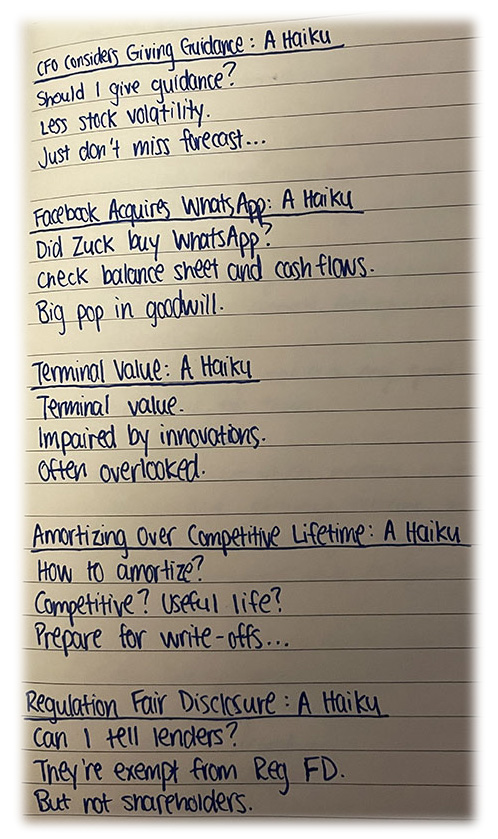

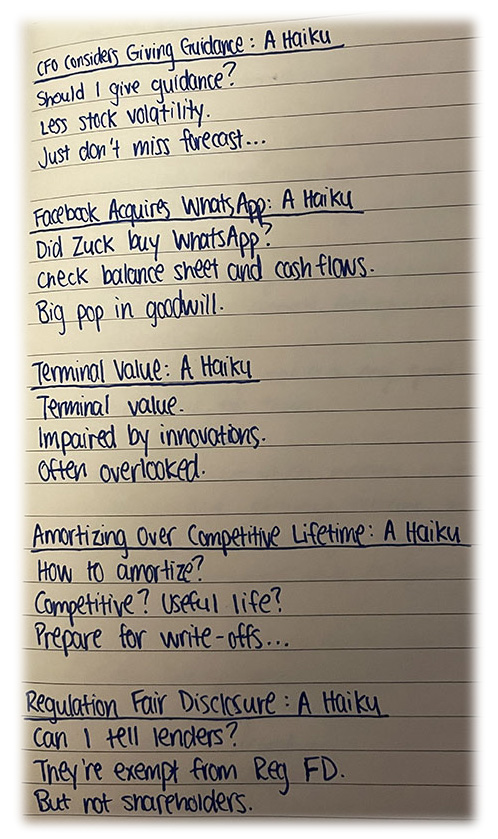

Student reactions? In a recent CFO class I taught at Dartmouth Tuck, I asked students to summarize each day of class in a journal. One of their posts and a couple remarks from their course evaluations appear below:

"Professor Schoenfeld is an exceptional professor. His method of teaching is very approachable and he shows mastery of distilling extremely complicated information into the key takeaways for us to leave the course with, while at the same time being sure to not outright ignore the important nuances and complexities. The content was fascinating and robust in revealing the perspective of a CFO when it comes to disclosure. The pace and workload were manageable but not insignificant."

"This course was one of the best I've ever taken at Tuck. My biggest 'criticism' was that I wish it had been a full-term course."

|

|